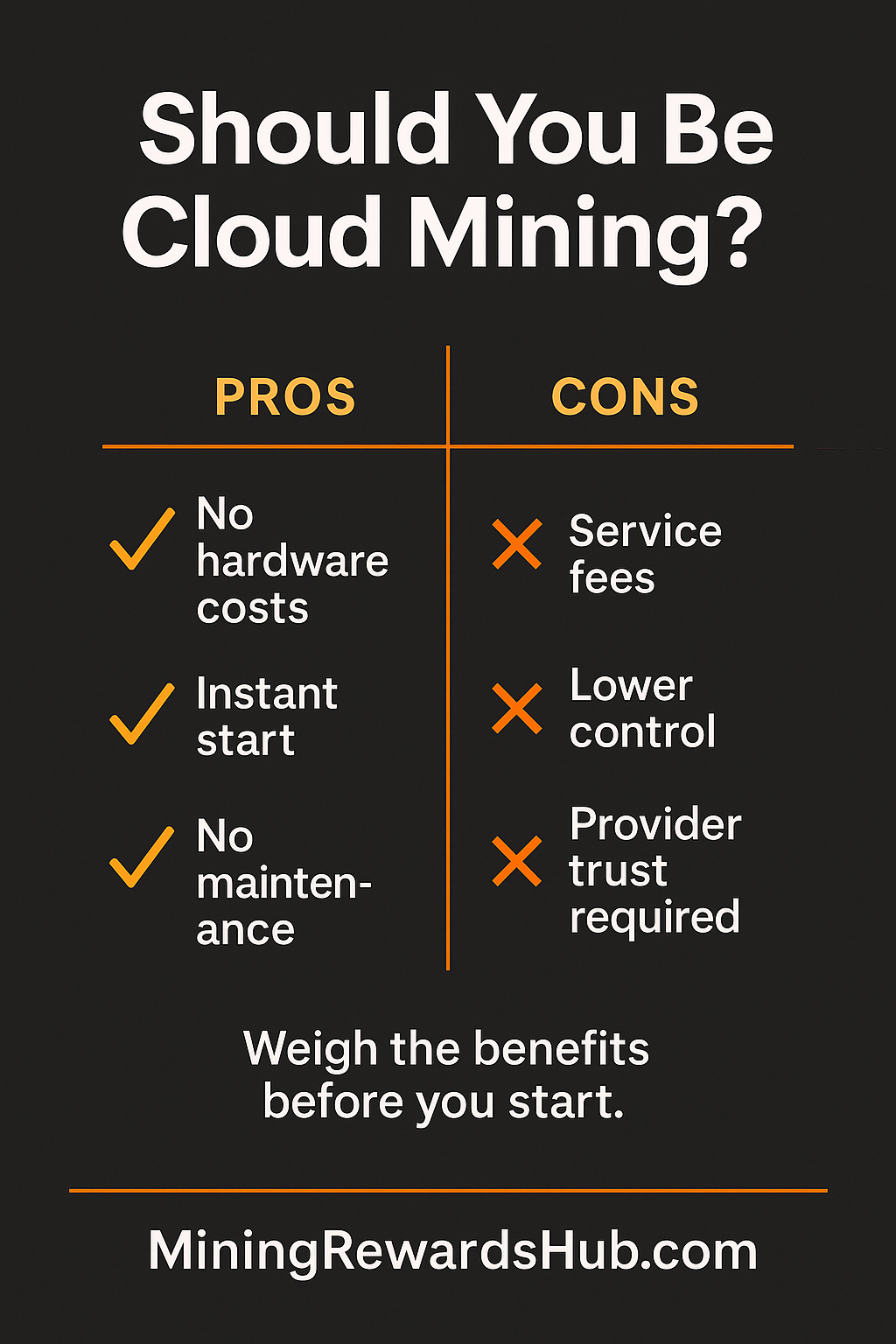

✅ Pros

- No hardware costs or noise/heat at home

- Fast start with professional operations

- Scales up/down without moving equipment

- Good for limited space or power access

❌ Cons

- Fees reduce net rewards

- Less control vs. owning ASICs

- Provider risk (transparency matters)

Safer Steps Before You Spend

Follow a quick validation path to avoid most pitfalls:

- Start with a small free-trial or test amount and confirm at least one payout path.

- Verify fee tables, withdrawal thresholds, and on-chain TXIDs or pool stats.

- Model outcomes using live numbers and halving context.

- Scale only if the math works after all fees.

Try a Guided Test First

Use our step-by-step to validate payouts, fees, and thresholds before you commit real money.

Open the Free 16 TH/s Trial Guide →When Cloud Mining Makes Sense

It’s a fit when you lack cheap power, space, or appetite for hardware maintenance—but still want exposure to mining rewards. If you have very low electricity costs and like running gear, owning an ASIC may outperform.

Understand Reward Shifts

Halvings and difficulty changes drive per-TH/s rewards. Review the full timeline.

See the Halving Chart →Frequently Asked Questions

Is cloud mining profitable in 2025?

It depends on price, difficulty, and fees. Use a small test first, confirm real payouts, then scale only if the math works.

What are the biggest risks?

High or changing fees, opaque providers, and withdrawal frictions. Favor transparency: published fee tables, on-chain TXIDs or pool stats, and realistic thresholds.

Is a phone miner enough to earn real BTC?

No. Phone “miners” are faucets or simulations. Real mining power runs in data centers; test cloud options with a small trial instead.